Fourth Quarter 2016 Benchmark Results for Mystery Shops and Resident Surveys Executive Summary

Ellis, Partners in Management Solutions is delighted to offer our Mystery Shopping and Resident Survey programs as modern and effective tools for an integrated solution to your sales, marketing, resident retention and business process improvement needs. For 33 years, we have been supporting apartment management companies and owners in the evaluation of their employee sales performance and effectiveness. We remain dedicated to the growing needs of our customers, as together we monitor and examine onsite leasing engagement and marketing effectiveness, and compare your team’s presentation to others in the industry throughout the customer lifecycle.

The 2016 Ellis Benchmark focus is to “Think Differently and Take Action”. This letter highlights the final point in the customer experience journey – The Close. We thank you for joining us each quarter as we convey combined Benchmark results and sales trends, and offer practical improvement ideas via our Ellis Training Video (ETV) series.

ELLIS’ FOURTH QUARTER 2016 BENCHMARK: OVERALL RESULTS

Mystery Shops

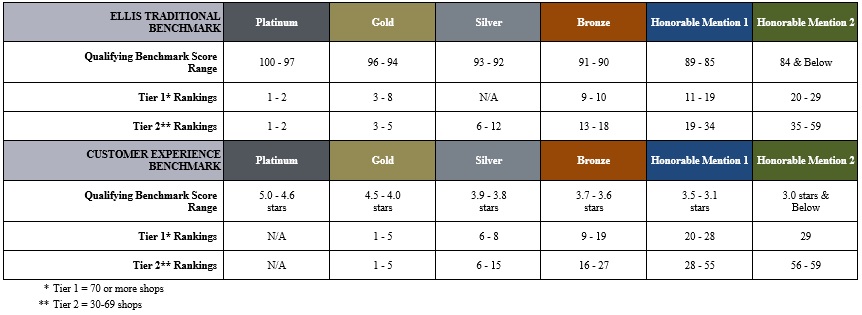

Ellis benchmarks mystery shop performance on the 10 key Benchmark questions and the Customer Experience. Companies can qualify for platinum, gold, silver, or bronze level based on their company’s overall Benchmark score for the quarter.

In 2015, the overall average Ellis Traditional Multifamily Industry Benchmark score across Ellis’ entire database of eligible shops1 was 86%, representing 41,342 shops. Compare this to 85% in Fourth Quarter 2016, representing 10,430 shops. In 2015, the overall average Ellis Customer Experience Benchmark score was 3.5, versus 3.6 for Fourth Quarter 2016. (Note: No tier or rank is provided if minimum requirements2 are not met.)

Resident Surveys

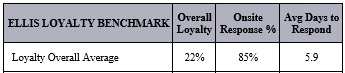

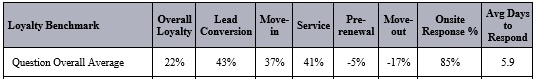

The Ellis Loyalty Benchmark identifies and recognizes the customer experience performance of companies subscribed to the Ellis Resident Survey Program. It evaluates performance on 5 key touch points (lead conversion, move-in, maintenance, renewal, move-out) of the prospect and resident journey. The percentage of surveys responded to by the onsite team and the average number of days it took for the team to respond are also measured, as these two factors impact the customer relationship and overall loyalty. Utilizing customer loyalty as a metric allows customer-centric companies the ability to forecast three specific customer behaviors: likelihood to convert/renew, willingness to pay more, and likelihood to recommend.

The customer loyalty scale ranges from -100% to 100% (see chart below):

The overall average Ellis Loyalty Benchmark score based on Ellis’ entire database of eligible surveys1 in 2015 was 17.5%. compared to 22% for the 4th Quarter 2016. The on-site response rate of 85% reflects a 3% increase over last quarter. Teams took an average of 5.9 days to respond back to customers versus 6.3 days in 3rd Quarter 2016.

CONGRATULATIONS ELLIS BENCHMARK TOP PERFORMING COMPANIES 4TH QUARTER 2016

Mystery Shop

Ellis Traditional Benchmark Platinum Level Achievers

Tier 1 (70 or more completed shops)

- Gables Residential Services

- Western National Property Management

Tier 2 (30 – 69 completed shops)

- GHP Management

- Legacy Partners Residential, Inc.

Ellis Customer Experience Benchmark Gold Level Achievers

Tier 1 (70 or more completed shops)

- AMLI Residential

- Gables Residential Services

- Irvine Company Apartment Communities

- Post Properties

- Windsor Property Management Co / GID

Tier 2 (30 – 69 completed shops)

- IMT Residential

- Legacy Partners Residential, Inc.

- Lennar Multifamily Communities

- Mill Creek Residential Trust

- ZRS Management, LLC

Resident Surveys

Ellis Best in Class Achievers

Tier 1 (1,600 or more units)

- CWS Apartment Homes, LLC

- Lennar Multifamily Communities

- Lincoln Property Company

- Manco Abbott

- Simpson Property Group

Tier 2 (1,599 or fewer units)

- Leslie Investment Properties Inc.

- TM Realty Services

*Companies are listed in alphabetical order

**Customer Experience Benchmark gold level achievers are recognized as there were no platinum achievers for this period

ELLIS’ FOURTH QUARTER 2016 BENCHMARK: QUESTION/TOUCHPOINT RESULTS

Mystery Shops

How did we do?

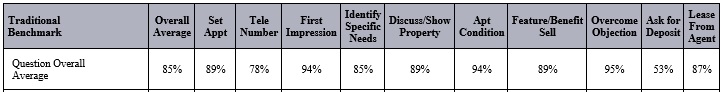

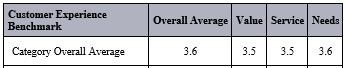

The charts below reflect the average score of Ellis’ entire database of eligible shops1 for each of the 10 key benchmark questions and the Customer Experience by category, as well as the combined overall Benchmark scores for Fourth Quarter 2016.

Resident Surveys

How did we do?

The chart below reflects the average scores across all Ellis Resident Survey companies for each survey touch point for Fourth Quarter 2016, as well as the combined overall loyalty score and average accountability performance results.

ENTERING THE CUSTOMER’S WORLD: MOVING FROM HARDLINE CLOSER TO TRUSTED ADVISOR

In 2016, we highlighted four selling areas that spoke to both potential customers and existing residents: Lead Conversion, First Impressions, and Selling Value. We now conclude our 2016 theme, “Think Differently and Take Action”, with our final focus area – The Close. There is a popularly-quoted statistic: 70% of the buyer’s journey is complete before they ever enter your front door. If they make it to your office, they are often operating on information overload. They have combed through social media, old media, and new media, and have pursued online and offline conversations with friends and family. Now, they are seeking an expert who can help them sift through their wheelbarrow full of data. According to author and speaker Brian Tracy, when it comes to influencing their final choice, “People don’t buy products, services, or solutions – they buy results.” These results are revealed through the insights a leasing professional unearths as they engage with customers. The winner’s circle is no longer filled with hardline closers who use 1960’s era techniques, but instead with trusted advisors who operate differently.

3 KEY BEHAVIORS OF A TRUSTED ADVISOR

1. They ask insightful questions, listen, and ask for the lease. From start to finish, a trusted advisor asks great insightful questions. The right questions at the right time in the sales process can help uncover the insights needed to understand what is important and the direction a customer is taking. In the absence of these insights, it is almost impossible to show how your business is relevant and to earn the credibility needed to persuade prospects to choose your community over the competition. Unfortunately, only 13% of customers believe a salesperson can understand their needs. The trusted advisor’s conversations take the relationship to a new level; they are authentic. “What do you like most about your current home?” “Have you ever considered a 1 bedroom with den as an alternative to a 2 bedroom?” “What are your needs in the kitchen?” “What is it about city living that is appealing to you?” These are a few examples of insightful questions which can provide more detail, challenge the customer’s original intentions, encourage reflection, and move the customer closer to a decision. Even if their decision is yes, customers almost never come out and say, “I want to lease this apartment right now.” No matter how interested they are, they will be inclined to walk out the door unless they are specifically asked for the sale. It does not require a pushy or aggressive close. If the leasing professional has done a good job in the rest of the presentation, the close will follow naturally and will seem like the next logical step for the customer. They are merely waiting for the question.

- EPMS DATA INSIGHT: During the 4th Quarter 2016, over 10,000 shopping reports revealed that 85% of leasing professionals successfully identified the needs of their customers. The same report exposed that only 53% of leasing professionals asked for the sale. Based on the overall leasing presentation, 87% of shoppers stated that they would have leased had they been asked. A simple calculation tells us that we potentially left up to 47% increase in sales on the table by not asking for the deposit.

2. They are subject matter experts. Trusted advisors are subject matter experts who convey product information to customers in a clear and concise manner. A Forrester survey found that buyers believe that just 62% of sales people have strong knowledge about their products and company. Possessing in-depth product, industry, and market knowledge allows a leasing professional to increase their value in the eyes of the customer. Only then can they offer credible and relevant options that will help their customer make a purchase decision. Customers always prefer the subject matter expert. They bring more value than the one who simply knows who to call to get questions answered. Customers assume the individual who occupies the front desk should have the depth of knowledge necessary to answer their questions. If they do not know as much or more than the prospective client knows, it will be difficult to create value and eventually close the sale.

- EPMS DATA INSIGHT: In 4th Quarter 2016, 89% of leasing professionals effectively presented both the product and the community to their customer.

3. They differentiate themselves from the competition. Advisors put the customer’s needs ahead of their own ambitions. A sincere desire to preserve and nurture the relationship is what sets them apart from the typical salesperson. They understand the importance of following up with their customers at various stages of their journey. They make the decision process easy for the customer, because the customer trusts the advisor has their best interests in mind. If the product does not meet their customer’s needs, they do not close the door. They continue in their advisory role, even if it means referring them to the competition. They have enough confidence to ask the hard questions, such as “Is there something that I could have done differently?” Finally, lease or no lease, they follow-up with the customer. The superstars use their pen and paper to send a handwritten thank you card!

- EPMS DATA INSIGHT: The year 2016 exposed some shocking realities about the lack of follow-up in our industry. Out of 48,762 shops, 47.4% of customers never received any kind of follow-up. When it did occur, it was email most often, then telephone, and finally snail mail. Although only 4.8% of leasing professionals chose to send a hand-written thank you note, studies show it has the greatest emotional impact. In addition to these traditional methods of follow up, several of our clients utilizing the Ellis Resident Survey program differentiate themselves further with their prospect surveys. Specifically, when a prospective resident submits a “prospect” survey, the onsite teams immediately respond to that prospect’s feedback. They are using survey feedback as a catalyst for more discussion of specific needs and concerns of the prospective customer. These actions continue to move the sale forward, resulting in more than a 10% increase in conversion rates.

Moving from a hardline closer to a trusted advisor takes time and investment of effort, and it must be developed through deliberate actions. Trust must be earned. According to Webster’s Dictionary, trust is defined as a firm belief in the reliability, truth, ability, or strength of someone or something. A trusted advisor embraces a new set of behaviors which give them a keen ability to diagnose a customer’s stated and unstated needs, and then to make the right recommendations to help the customer form an educated purchasing decision. Their ability to ask insightful questions, perform as subject matter experts, and discover ways to differentiate themselves from the competition, are just a few examples of how they operate in their own unique way. Closing the sale does not mark the end of the relationship between a trusted advisor and their customer. It marks the beginning of the next sales cycle.

ELLIS TRAINING VIDEO (ETV)

Now it is time to go online and join ‘Anna Leaser’ and ‘Franc Buyer’ as they share some practical ways to “Close the Sale” differently via the latest Ellis Training Video (ETV).

We thank you for your ongoing participation and feedback, which help make this report informative, fresh, and a reliable resource. We hope you will find Ellis Partners in Management Solutions to be not only the finest source for mystery shopping and resident surveys but also a training resource for your organization. Additional support and information can be found on our website.

January 31, 2017

Prepared by Joanna Ellis, Chief Executive Officer and Francis Chow, Chief Strategic Officer

Ellis, Partners in Management Solutions (EPMS)

1333 Corporate Drive

Suite 266

Irving, TX 75038

888.988.3767 telephone

[email protected]

www.epmsonline.com

Footnotes:

1 See Ellis website for Benchmark eligibility, tier level, and recognition requirements for mystery shops and resident surveys.

2 No tier or rank is provided when minimum requirements are not met.